limited pay life policy coverage

LEIMBERG KEITH A. You get death benefits and lump-sum cash that accumulates during the policy period.

Life Insurance Living Benefits Coastal Wealth Management

A limited pay life policy is a type of whole life insurance.

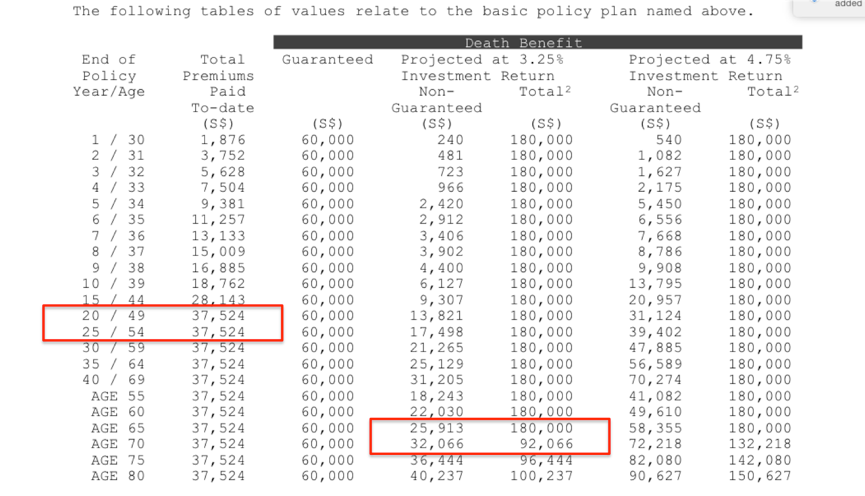

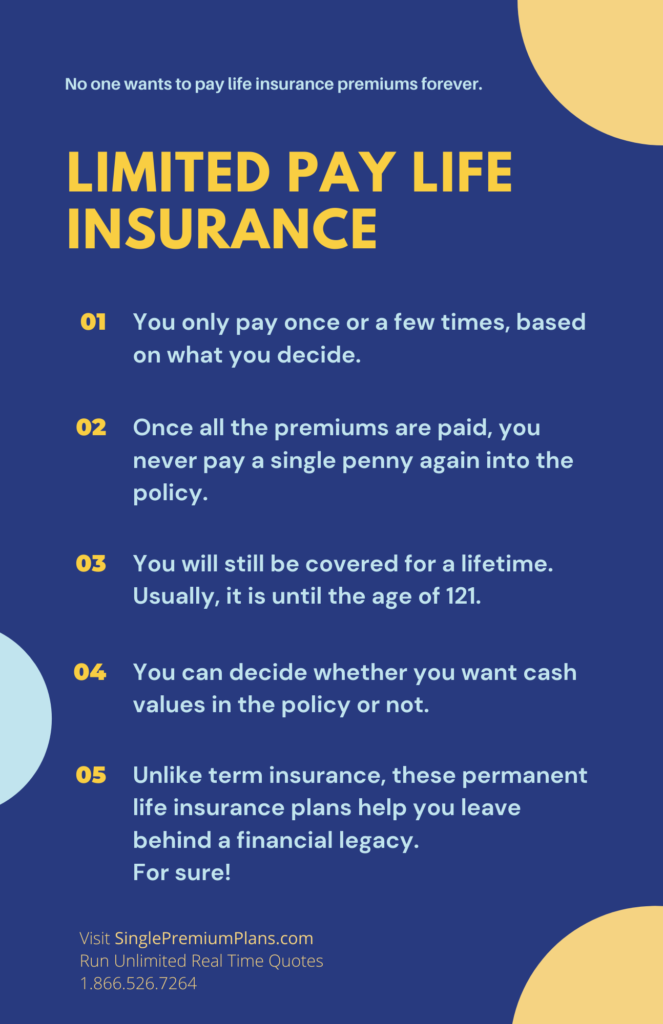

. Limited Pay Unlimited Time of Death Benefit Limited Yearly Premiums A simple example of this may be a 20 year 500000 term life insurance policy which say is 250 per year. With a limited pay whole life insurance policy youre required to pay a premium for a predetermined number of years or until you reach a specific age. You can purchase a whole life.

Limited Policy coverage is a basic type of insurance policy that only pays benefits in the event of certain occurrences or specific events as specified in the contract. With limited pay life you only pay for a set number of years or until you. The advantage of this policy is that the premiums are spread out over 30 years resulting.

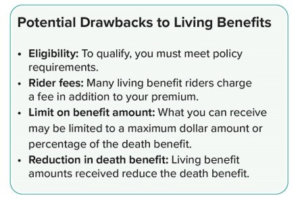

Typically these types of policies are paid off in 10-20 years. A limited pay life insurance policy provides lifelong coverage without a lifelong premium payment. A limited pay insurance policy is a type of permanent life insurance product sometimes called whole life in which the policyholder pays premiums over a set period of time or until a specific.

Limited pay policies are usually whole life insurance policies that schedule premium payments over a finite period. John is a 45-year-old male. A limited payment life policy is ideal for a child - in addition to starting insurance coverage they will need as an adult the policy earns cash value which generally grows tax-deferred.

At that point you are no. Because limited pay policies have fewer premiums to reach paid-up status they need more significant premiums yearly than continuous pay insurance policies. This option allows you to pay the premium for a limited period but the life insurance cover continues throughout the policy tenure.

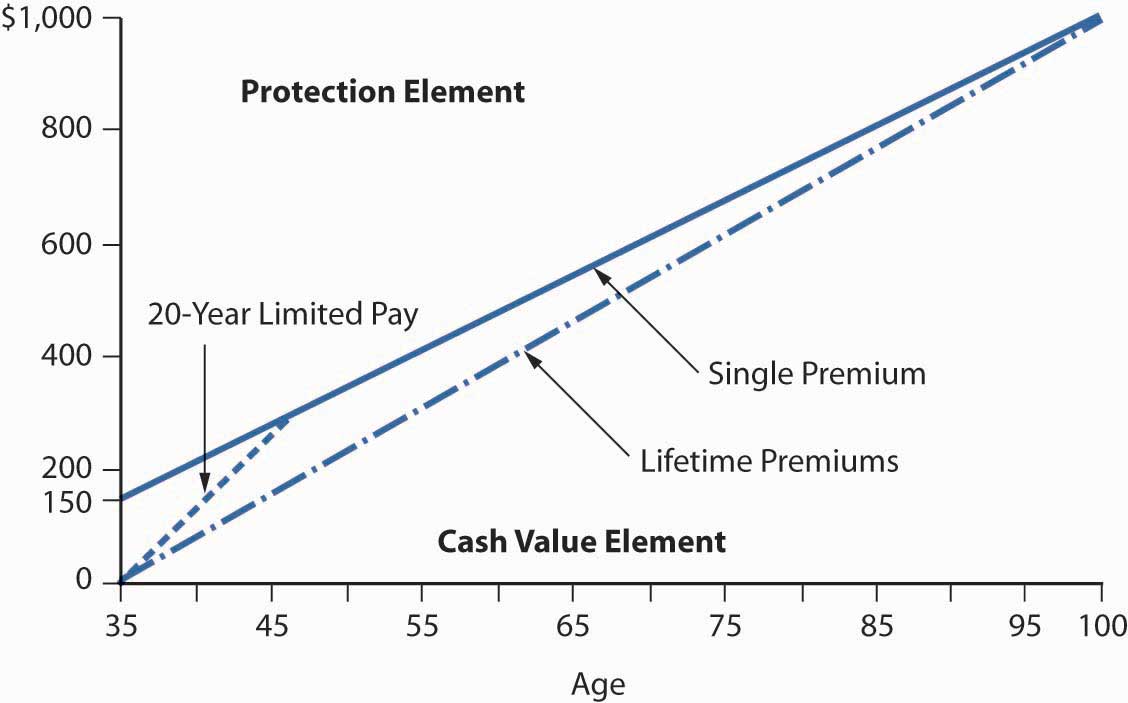

Typically when purchasing whole life insurance you have to pay premiums for as long as you want the plan. Limited pay life insurance is a life insurance contract between you the ownerinsured and the carrier the insurer for the benefit of the beneficiary that requires. The incremental limited pay life insurance between 10 years and 30 years is able to adjusted or customized depending on WHEN you want to stop.

A limited pay life insurance policy allows you to pay your insurance premiums in full within a certain time frame Limited pay policies work well for people who prefer not to pay. Limited Pay Whole Life Insurance What is the Difference Between a Paid Up Life Insurance Policy and a Matured Policy. How Does Limited Pay Life Insurance Work.

10- or 20- or 25-Pay Whole Life Policies. 7-pay life insurance life paid up to 65 and. Limited payment whole life insurance covers you for life.

The number of years of premium. Rather than paying premiums for as long as you live. 30 Pay Life provides coverage for the rest of your life with premiums due every 30 years.

A limited-pay life policy is a type of whole life insurance policy that you can pay off in advance. A limited-pay life policy requires the policyholder to pay premiums for a limited number of years but its coverage last a lifetime. For example limited life.

Unlike regular whole life insurance the beneficiary pays premiums over a shorter time instead of their entire lifetime. In other words rather than paying your. Limited pay life insurance is a type of whole life insurance policy that is structured to only owe premiums for a set number of years.

These limited benefit life insurance policies allow you to pay premiums over a period of time usually 10 15 20 or up to age 65 but you get continuous coverage for life.

Are Limited Pay Life Insurance Policies Ideal

What Is Limited Pay Whole Life Helpadvisor Com

Whole Life Insurance The Ultimate Explanation Online

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

Term Vs Whole Life Insurance What S The Difference

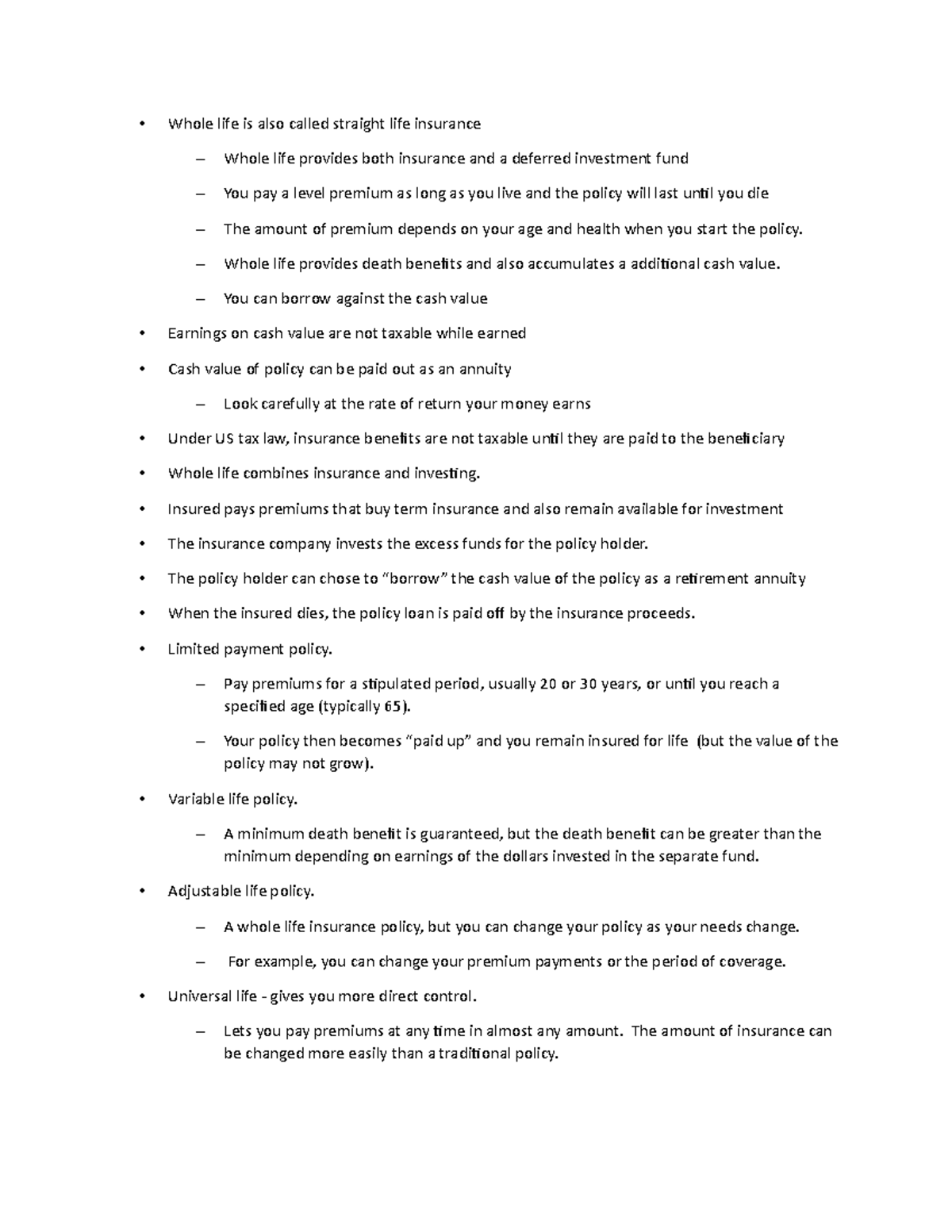

Life Insurance 2 Lecture Notes 15 Whole Life Is Also Called Straight Life Insurance Whole Life Studocu

What Is Limited Pay Life Insurance Paradigm Life Insurance

/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

Term Vs Whole Life Insurance What S The Difference

Comprehensive Guide For Buying A Limited Pay Life Policy

What Is Limited Pay Life Insurance Policyadvisor

Mortality Risk Management Individual Life Insurance And Group Life Insurance

Should You Get A Whole Life Insurance Policy We Explain In Details How It Works

Comprehensive Guide For Buying A Limited Pay Life Policy

An Outline Of The Various Types Of Life Insurance Policies Financial Independence Hub

How Can Whole Life Insurance Premiums Remain Level Bank On Yourself

Finance Final Set The Most Basic Distinction Between Types Of Life Insurance Policies Is Studocu

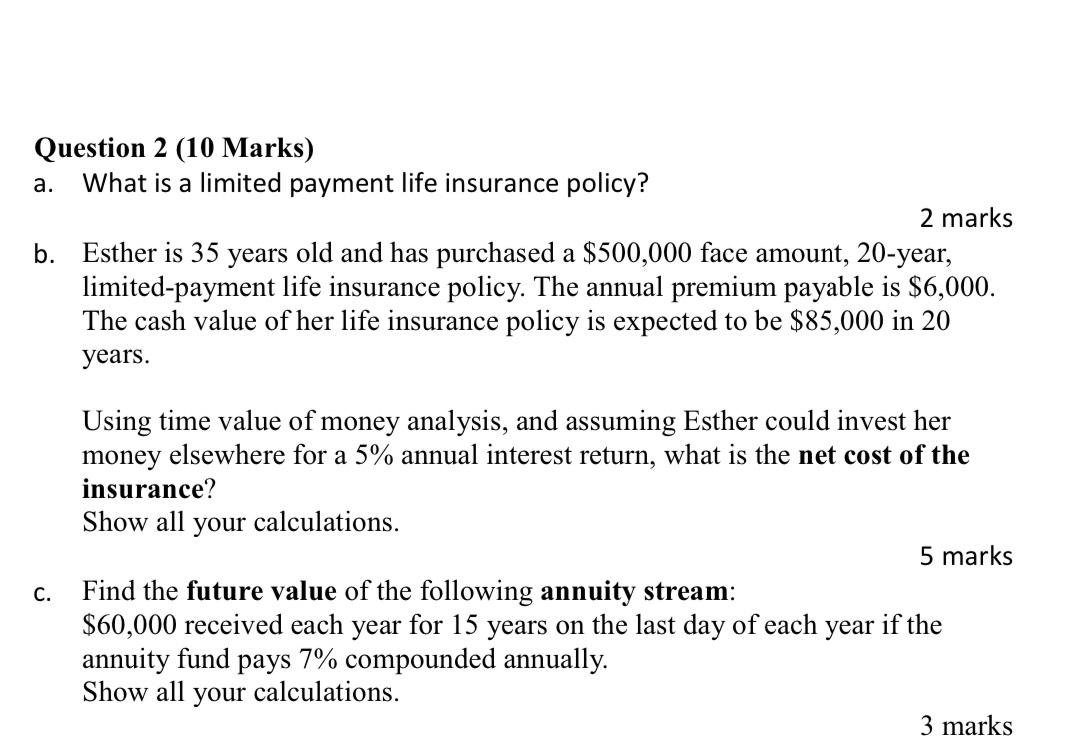

Solved Question 2 10 Marks A What Is A Limited Payment Chegg Com

Single Premium Life Insurance Pros And Cons